Hi, in this session, I'm going to cover how to create a form letter using the Microsoft Word mail merge feature along with Microsoft Excel. You can think of mail merge as a process where you have a template and you want to be able to use this template and change certain elements such as the recipient's name and address, while keeping the rest of the letter the same. This can be done by combining the template with a database or table of names and addresses. To get started with mail merge in Word and Excel, the first thing we need to do is open Microsoft Word. You may already have a template set up with some text or copy that you want to use for your letters. You can customize this template by adding placeholders for the name and address, as well as any other information that you want to personalize. Next, make sure you have your Excel table set up with the necessary columns for the recipient's first name, last name, address, city, state, and zip code. This table will serve as the input for the mail merge. Now, back in Word, go to the "Mailings" tab and find the "Start Mail Merge" group. Click on "Start Mail Merge" and select the "Step by Step Mail Merge Wizard" option. This will take you through a series of six steps to complete the mail merge. The first step is to select the type of document you want to create. In our case, we are creating letters, so choose "Letters" and click "Next" to proceed. In the next step, you can choose to use the current document or start from a template. Select the appropriate option and click "Next" to continue. The third step involves selecting the recipients for your mail merge. Choose the option that...

Award-winning PDF software

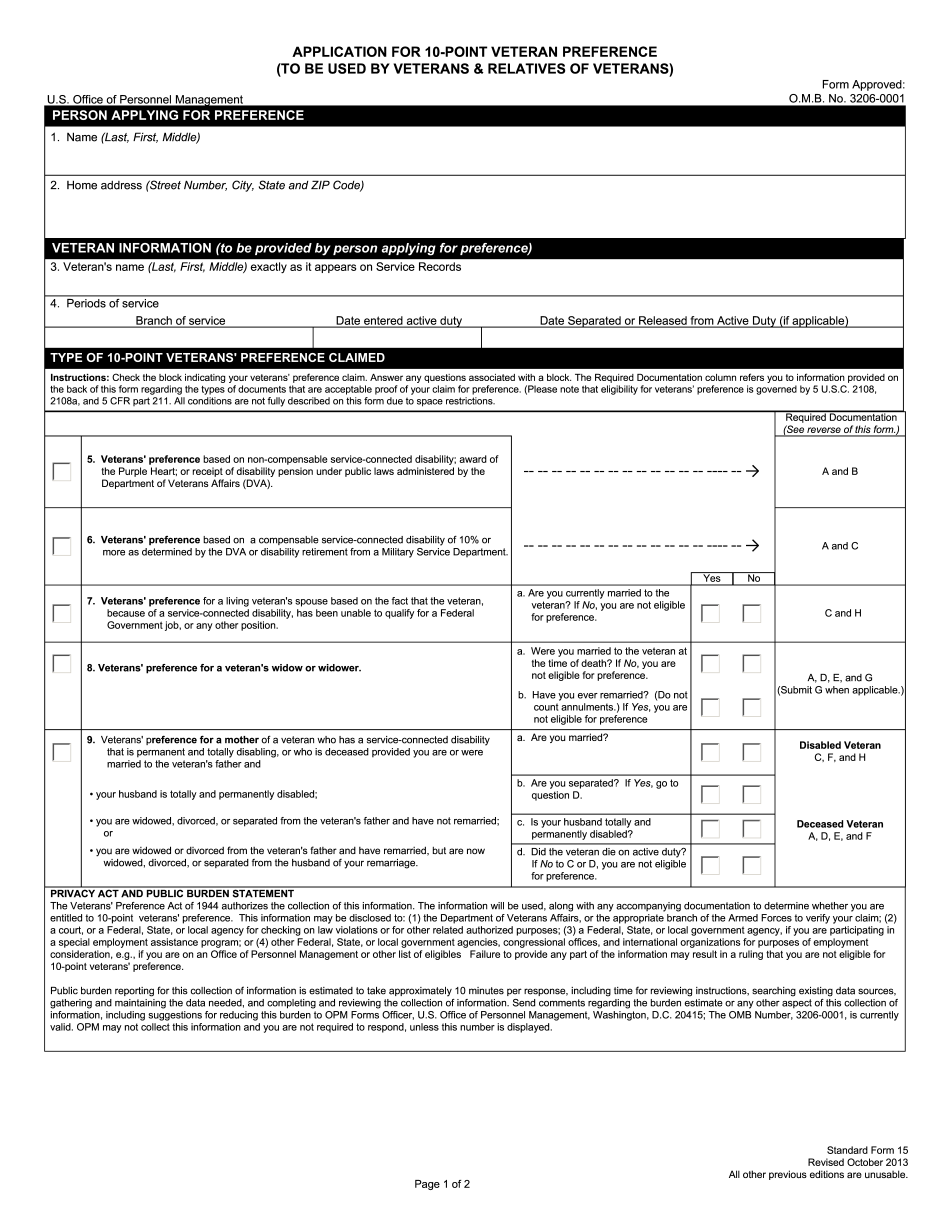

Sf-50 fillable and savable Form: What You Should Know

Inventory Tracking and Support System (ITS) — ITS Inventory Tracking Software Form 1099-MISC Form 1099-MISC is a summary form that reports your income, estimated cash flow and net worth, and deductions for certain tax-exempt organizations such as churches, and others. It does not report deductions for your personal expenses like mortgage interest. You may fill out this form if you are filing a tax return and would like to File a Tax Return For Nonprofit Status (IRS Form 1065) — Instructions Form 1099-MISC Form 1059, U.S. Individual Income Tax Return, Federal Individual Income Tax Return Form 1049 Form 1049 is a document showing your name, address, social security number, and filing status, such as single, married, filing a joint return, married filing and single filing joint return. (See Related Topic) Form 1049 Form 1049 (Form 1038) is the U.S. tax payment confirmation document, usually required by U.S. customers of online banks to process your tax payment by credit card (using an email address provided by the bank). Form 1049 This form is filed each year by all taxpayers, usually around April 15th of the tax year. It shows your name, mailing address, taxpayer account number for tax year 2017. The last line of the IRS Form 1033 that has not been filled out is called the Form 1049. File a U.S. Individual Income Tax Return (Form 1040), to show your income, estimated income, cash flows for 2017, and the amount of taxes due. The IRS form 1040 (and other forms) should be filed with the IRS by April 15th, 2018. Form 1040EZ Form 1040EZ—U.S. Individual Income Tax Return with Estimated Income Form 1040EZ is for taxpayers filing income tax returns for 2016, 2025 and 2018. Form 1040EZ shows estimated income for 2016, 2025 and 2018. The IRS Form 2115 (for married couples filing joint) Form 926 Form 926 is a form for those businesses filing Form 926. Form 926 forms include information about your business such as your name, physical address, business licenses and permits, bank account information and contact information, and business investment and trade related information.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form SF-15, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form SF-15 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form SF-15 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form SF-15 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Sf-50 fillable and savable