PDF editing your way

Complete or edit your sf 15 anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export sf 15 form directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your sf15 as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your sf 15 fillable by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

How to prepare Form SF-15

About Form SF-15

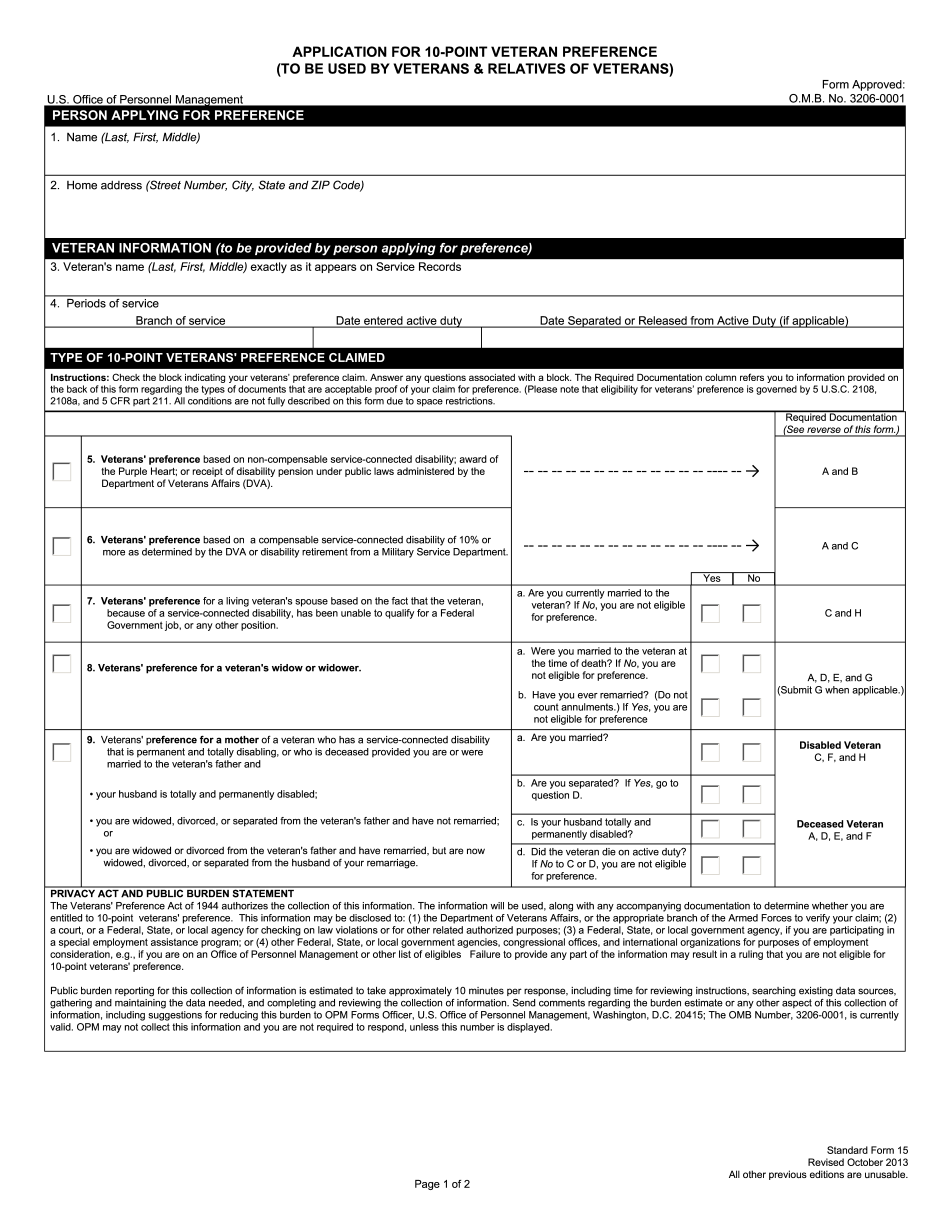

Form SF-15, also known as the Application for 10-Point Veteran Preference, is a document used by veterans seeking employment in the federal government. This form is designed to establish the level of preference a veteran is entitled to receive when competing for federal job openings. Specifically, the SF-15 allows veterans to claim a 10-point preference based on their military service, disability, or other qualifying factors. This preference can be a significant advantage when competing with other candidates for federal job openings. Any veteran who meets the eligibility requirements for federal employment may use this form to claim veteran preference. Other individuals who may be eligible for the 10-point preference include certain family members of disabled or deceased veterans.

What Is SF-15 Form?

Different Federal agencies and personnel examining offices use Form SF-15. This application is designed to verify if an individual is eligible to receive veteran’s benefits. In 1994, when the government instated the Veteran’s Preference Act, it became necessary to fill out this form.

It is also known as the Application for 10-Point Veteran Preference and it may be filed by the veterans and their relatives. If a veteran has a service-connected disability or obtained a Purple Heart, a 10-point preference may be claimed. Generally, Congress determines the eligibility for the preferences under the United States Code.

Frequently, the veterans complete this Standard Form 15 to apply such preference as the employment. It is necessary to indicate the type of preference in the application. Certain qualifications must be met to obtain the eligibility for the preferences. The veterans must be the retirees of the military service or honorably discharged. If the veteran is disabled, it is necessary to include this information in the form. It may provide even more benefits.

What is Form SF-15 Used for?

The purpose of Form SF-15 is the confirmation of 10-point veteran’s preference eligibility. There are several types of this preference. They are the following:

-

10-point disability: this preference is aimed at the Armed Forces former members who were separated and have a 10% or less disability connected with the service. They can receive the benefits if they were not awarded a compensation;

-

10-point compensable: the Armed Forces former members who were separated and have less than 30% of the disability are eligible for this preference type. They can receive the benefits if they were not awarded a compensation;

-

10-point other: if you are the occupationally disabled veteran’s spouse or mother, you can receive this benefit;

-

10-point/30% compensable: this preference is available if your disability connected with service exceeds 30% or even more;

How to Get SF-15

Make your life easier! Could it be true that you do not have more important things to do in your life than filing this application? Forget about printable documents and manual completion. Save your time and devote it to what you like. Our site will help you do that.

Download your VA SF-15 either in PDF or Word format, fill it out electronically, correct the mistakes in seconds and add as many fillable fields as you need to include all necessary information. Your SF-15 will be a perfect sample if completed using our tools.

Online answers help you to prepare your document management and improve the efficiency of your workflow. Observe the short guideline in an effort to full Form SF-15, stay away from errors and furnish it in the well timed manner:

How to accomplish a Form SF-15 on-line:

- On the web site using the kind, click Begin Now and go into the editor.

- Use the clues to complete the appropriate fields.

- Include your individual knowledge and call details.

- Make guaranteed that you simply enter suitable information and figures in best suited fields.

- Carefully check out the subject material in the variety also as grammar and spelling.

- Refer to assist section for people with any queries or deal with our Support team.

- Put an digital signature with your Form SF-15 along with the aid of Signal Resource.

- Once the shape is completed, press Executed.

- Distribute the completely ready kind through electronic mail or fax, print it out or help you save on the machine.

PDF editor allows for you to definitely make improvements to your Form SF-15 from any World Wide Web related system, customize it as per your requirements, indicator it electronically and distribute in several ways.