Award-winning PDF software

Sf-50 fillable Form: What You Should Know

The vendors and information providers are not employees of the Florida Department of Revenue, they are independent contractors. If you have questions or concerns please call the Department of Revenue Special Tax Unit at. The Florida Department of Revenue Special Tax Unit is the agency that is responsible for reviewing, processing, and issuing alternative tax forms and other tax documentation. Electronic Filing of Alternative Tax Returns — Florida Dept. of Revenue The Florida Department of Revenue is responsible for collecting, maintaining, and filing Florida Alternative Tax returns. Taxpayers must use an Electronic Filing service or a paper return to file the following: Electronic Filing of Alternative Tax Returns — Florida Dept. of Revenue Florida Sales and Use Tax Payment and Tax Credits Sales and use tax must be paid in order for the sales, use, and use tax credit to be calculated. If the sales tax is not paid, then the tax credit is lost. You will receive a tax bill. You should have the sales tax refund form and a copy of the notice sent to you via regular mail or by email. The taxpayer will need to either accept the tax bill or send in a payment. The tax bill will need to be on a form that has information about the sales tax paid and the tax credit received. Florida Sales and Use Tax and Credits — Florida Department of Revenue Sales and Use Tax and Sales and Use Tax Credit Credits are provided at the time of sale of goods or services, not the time of purchase. If you use a sales and use tax discount code, then the sales tax discount code must be applied by the time you make your purchase. To apply the sales and use tax credit, use either the Online Form or Paper Returns Form for your State sales and use tax certificate (T2-S5A or T2-S5C) for the amount. Enter the applicable T1-A number to be entered in line 12 of line 23. Sales Tax Credit Schedule — Florida Department of Revenue Sales Tax Credit Schedule — Florida Department of Revenue Sales and use tax refunds. The sales tax refund application must be filed by the filing deadline. If the sales tax refund was issued due to a sale of qualifying commodities, merchandise, or equipment, the sales tax refund must be posted to the taxpayer's account within 2 weeks. If you are filing by mail, the sale of qualifying commodities, merchandise, or equipment is exempt and the refund will be mailed to the taxpayer.

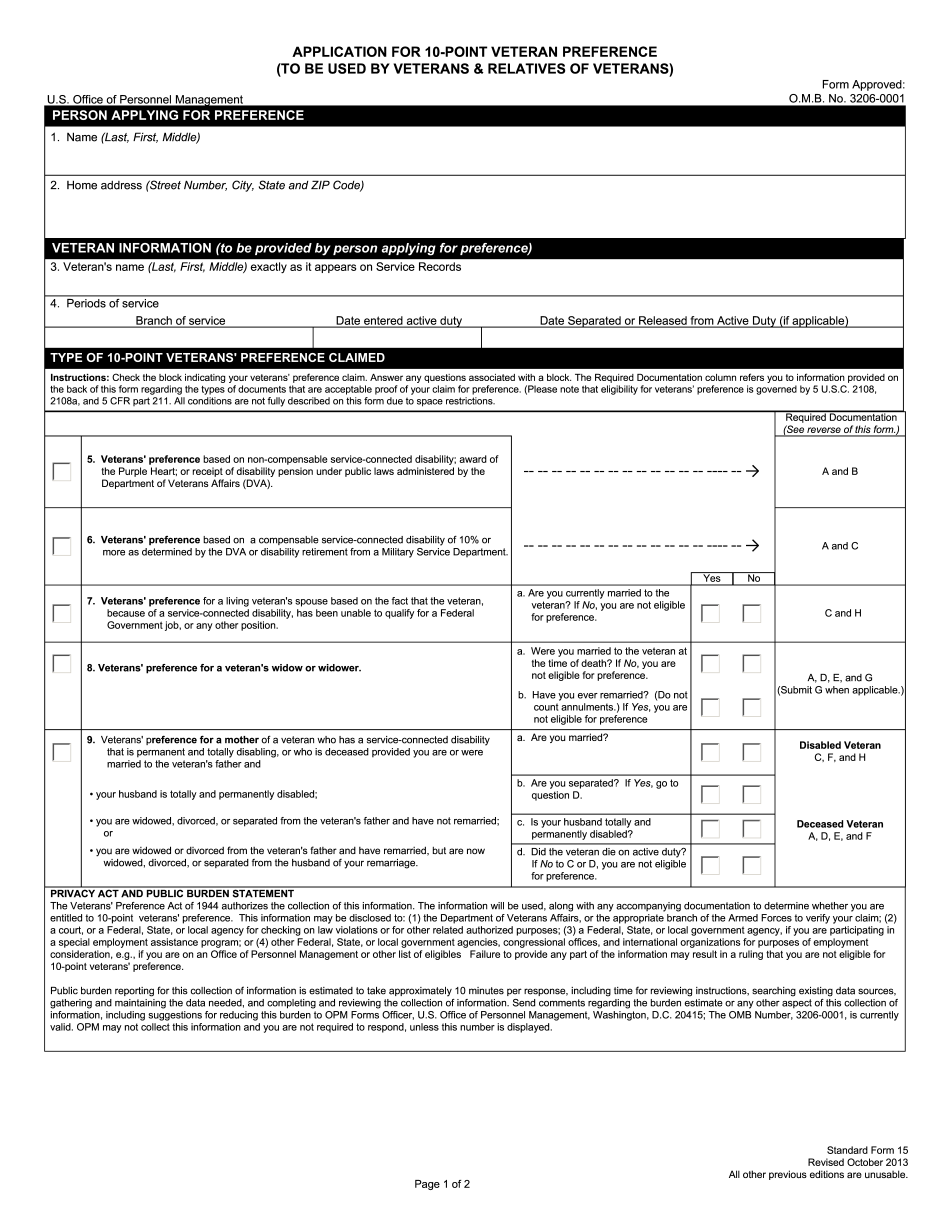

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form SF-15, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form SF-15 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form SF-15 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form SF-15 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.